Curious about Actual PRMIA PRM (8006) Exam Questions?

Here are sample PRMIA I: Finance Theory, Financial Instruments, Financial Markets – 2015 Edition (8006) Exam questions from real exam. You can get more PRMIA PRM (8006) Exam premium practice questions at TestInsights.

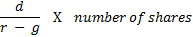

According to the dividend discount model, if d be the dividend per share in perpetuity of a company and g its expected growth rate, what would the share price of the company be. 'r' is the discount rate.

A.

B.

C.

D.

Correct : A

According to the dividend discount model, the spot share prices represent the present value of all the future cash flows from the stock. If held till perpetuity, this becomes an annuity equal to the dividend, growing at its expected growth rate. Therefore Choice 'a' is the correct answer. Choice 'c' would represent the total market cap, and not the value per share that the question asks.

Start a Discussions

Which of the following markets are characterized by the presence of a market maker always making two-way prices?

Correct : A

Over the counter and electronic communication networks match buyers and sellers. However, there is no market making function, ie, in periods of stress liquidity may completely disappear from these markets. Exchanges normally have market makers that are required to present two way quotes on the securities they are making the market for. Therefore Choice 'a' is the correct answer.

Start a Discussions

The Federal Reserve tries to limit margin trading using which of the following techniques?

Correct : A

In the US, the Federal Reserve sets a limit (eg, 2 x, so that only 50% of the money could be borrowed) as a multiple of capital posted to prevent excessive leverage or gearing in the system.

The other choices are incorrect.

Start a Discussions

In terms of notional values traded, which of the following represents the largest share of total traded futures and options globally?

Correct : D

Equity futures are by far the most traded futures contracts in terms of value, followed by interest rate products. Choice 'd' is the correct answer.

Start a Discussions

It is October. A grower of crops is concerned that January temperatures might be too low and destroy his crop. A heating-degree-days futures contract (HDD futures contract) is available for his city. What would be the best course of action for the grower?

Correct : B

This question is based upon a weather derivative contract traded on the CME in the US. For each day, 'Heating-Degree-Days' (HDD) is calculated as equal to 65 degrees Fahrenheit minus the daily average temperature. The daily average temperature is based upon the temperature reported by the Earth Satellite Corporation using a specified automated weather station. Based upon daily values of HDD, an aggregated number called the 'CME degree days index' is calculated for each contract month. In other words, the index for a particular month is just the aggregation of the 'HDD' value for each of the days of that month. Each contract settles at the end of the month at a value equal to $20 x Degree Days Index. (In a similar way, 'Cooling Degree Days' are also calculated and a futures contract offered, except that CDD is equal to the average daily temperature minus 65 degrees). (Source: CME's website at CMEGroup.com)

In the given question, we are interested in hedging against the possibility of the temperature being too low. This means we should buy the HDD futures contract (the lower the temperature, the higher the difference of the average temperature from 65 degrees, and the higher the settlement). Therefore Choice 'b' is the correct answer. The lower the actual temperature turns out to be, the higher the payout to the grower. It would not be wise to wait till January to buy the contract as by then the prices of the contract would have already risen if the grower's fears of a colder January appear to be coming true. He can hedge his exposure by immediately locking in the January prices.

Start a Discussions

Total 287 questions