Curious about Actual Pegasystems Pega Certified Decisioning Consultant (PEGAPCDC87V1) Exam Questions?

Here are sample Pegasystems Certified Pega Decisioning Consultant (PCDC) 87V1 (PEGAPCDC87V1) Exam questions from real exam. You can get more Pegasystems Pega Certified Decisioning Consultant (PEGAPCDC87V1) Exam premium practice questions at TestInsights.

Reference module: Testing engagement policy conditions using audience simulation.

U+ Bank, a retail bank, recently implemented a project in which credit card offers are presented to qualified customers when the customers log in to the web self-service portal. The bank now plans to amend its engagement policy conditions. As a Decisioning Consultant, which simulation do you run to check if the conditions are too broad or narrow for your requirements?

Correct : A

Understanding the Requirement:

U+ Bank wants to test the engagement policy conditions to ensure they are neither too broad nor too narrow.

Audience Simulation:

Audience simulation tests the engagement policy conditions by simulating how many customers would receive each action based on the current policy rules.

It helps identify if the policies are effectively filtering the intended customers.

Running the Simulation:

Configure the simulation to include the engagement policy conditions.

Analyze the results to see the percentage of the audience that meets each criterion and receives the actions.

Steps to Run Audience Simulation:

Log in to the Pega Customer Decision Hub portal.

Navigate to the Engagement policy tab.

Select Actions -> Audience simulation.

Create or select a simulation and analyze the results.

Verification from Pega Documentation:

The Pega Customer Decision Hub User Guide outlines the use of audience simulations to test and refine engagement policies.

Start a Discussions

Reference module: Analyzing customer distribution using Pega Value Finder.

As a Decisioning Consultant, you have just implemented a project to present mortgage offers to customers on their self-service portals. The bank asks you to pull data on the distribution of the offers to well-engaged, under-engaged, or not-engaged customers. Which simulation do you run to get the required information?

Correct : D

To analyze the distribution of offers to well-engaged, under-engaged, or not-engaged customers, you would run the Pega Value Finder simulation. The Value Finder tool is designed to help identify and understand the engagement levels of different customer segments.

Pega Value Finder:

Pega Value Finder is used to identify under-served or over-served customers by analyzing historical interaction data.

It provides insights into how well different customer segments are being served and helps in understanding engagement levels.

This tool can categorize customers into well-engaged, under-engaged, or not-engaged based on their interactions and responses to offers.

Therefore, to get the required information on customer distribution based on engagement levels, Pega Value Finder is the appropriate tool to use.

Start a Discussions

Reference module: Creating engagement strategies using customer credit score.

MyCo, a mobile company, uses a scorecard rule in a decision strategy to compute the postpaid credit limit for a customer. MyCo updated their scorecard to include a new property in the calculation: customer annual income. As a Strategy Designer, what changes do you need to make to the decision strategy for the updated scorecard to take effect?

Correct : C

When MyCo updates their scorecard to include a new property, such as customer annual income, in the calculation of the postpaid credit limit, the decision strategy itself does not need to be changed to reflect the updated scorecard. This is because the scorecard rule already encapsulates the logic for calculating the credit limit, including any new properties added.

Scorecard Rule Update:

The scorecard rule in Pega is responsible for computing scores based on various properties.

If the scorecard rule is updated to include a new property, the decision strategy referencing this scorecard automatically uses the updated scorecard without requiring any additional changes to the strategy itself.

Decision Strategy:

The decision strategy references the scorecard rule, and as long as the reference remains unchanged, any updates to the scorecard are automatically applied.

There is no need to remap properties, add proposition filters, or set new properties within the strategy.

Implementation:

Ensure that the scorecard rule is correctly updated and tested to include the new property.

The decision strategy continues to use the updated scorecard without any modifications.

[Pega-Customer-Decision-Hub-User-Guide-85.pdf, 'Creating strategies manually', pg. 290]

Analysis based on the described functionality and standard practices in Pega Decision Strategies.

Therefore, no change is required in the decision strategy for the updated scorecard to take effect.

Start a Discussions

Reference module: Creating eligibility rules using customer risk segments.

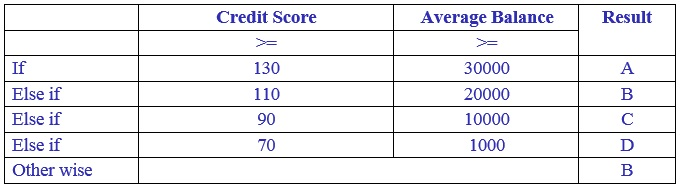

U+ Bank uses a decision table to return a label for a customer. Examine this decision table and select which label is returned for a customer with a credit score of 115 and an average balance of 15000.

Correct : B

To determine the label returned by a decision table for a customer with a credit score of 115 and an average balance of 15000, you need to examine the decision table rules. Based on the typical structure of decision tables, a credit score of 115 and an average balance of 15000 would fall within the ranges specified for the label 'B'.

Creating and using decision tables for customer segmentation (Page 72-73)

Example decision table configurations (Page 74-75)

Start a Discussions

As a Customer Service Representative, you present an offer to a customer who called to learn more about a new product. The customer rejects the offer.

What is the next step that Pega Customer Decision Hub takes?

Correct : B

Understand the Scenario: A Customer Service Representative (CSR) presents an offer to a customer, and the customer rejects the offer.

Next Step in Pega CDH:

In Pega Customer Decision Hub, when an offer is rejected, the system typically reevaluates the Next-Best-Action. This means it reassesses the available actions to determine the most appropriate next step for the customer based on current context and customer data.

Explanation of Other Options:

Sends a detailed email about the offer: This is not a standard next step in response to an offer rejection. The system focuses on reevaluating actions rather than automatically sending follow-up emails.

Adds the customer to the potential churn list: This action would depend on broader churn prediction strategies, not an immediate response to a single offer rejection.

Stops presenting offers to the customer: Pega CDH does not stop all offers based on a single rejection. It continuously evaluates and presents the most relevant offers.

Conclusion: When a customer rejects an offer, Pega Customer Decision Hub reevaluates the Next-Best-Action to determine the subsequent appropriate action.

Start a Discussions

Total 184 questions