Curious about Actual CIPS Level 6 Professional Diploma in Procurement and Supply (L6M2) Exam Questions?

Here are sample CIPS Global Commercial Strategy (L6M2) Exam questions from real exam. You can get more CIPS Level 6 Professional Diploma in Procurement and Supply (L6M2) Exam premium practice questions at TestInsights.

SIMULATION

Discuss supply and demand factors in foreign exchange

Correct : A

Supply and Demand Factors in Foreign Exchange

Introduction

The foreign exchange (Forex) market operates on the fundamental principle of supply and demand, which determines currency values. When demand for a currency rises, its value appreciates, while an oversupply causes depreciation.

Several factors influence the supply and demand of foreign currencies, including interest rates, inflation, trade balances, investor sentiment, and geopolitical events.

This answer explores the key supply and demand factors in Forex markets and how they impact exchange rates.

1. Demand Factors in Foreign Exchange (What Increases Demand for a Currency?)

1.1 Interest Rate Differentials (Higher Interest Rates Attract Capital Inflows)

Why It Affects Demand?

Investors seek higher returns on savings and investments.

Higher interest rates increase demand for the country's currency.

Example:

When the US Federal Reserve raises interest rates, the US dollar (USD) strengthens as global investors buy USD-denominated assets.

Key Takeaway: Countries with higher interest rates attract more investors, increasing currency demand.

1.2 Inflation Rates (Low Inflation Strengthens Currency Demand)

Why It Affects Demand?

Lower inflation preserves purchasing power, making the currency more attractive.

High inflation erodes currency value, reducing demand.

Example:

The Swiss Franc (CHF) remains strong due to Switzerland's low inflation and economic stability.

In contrast, Turkey's Lira (TRY) depreciated due to high inflation, reducing investor confidence.

Key Takeaway: Stable inflation rates encourage demand for a currency, while high inflation weakens it.

1.3 Trade Balance & Current Account Surplus (Export-Led Demand for a Currency)

Why It Affects Demand?

A trade surplus (exports > imports) increases demand for a country's currency.

Foreign buyers need the country's currency to pay for goods and services.

Example:

China's trade surplus increases demand for the Chinese Yuan (CNY) as global buyers purchase Chinese goods.

Germany's strong exports strengthen the Euro (EUR) due to high international trade.

Key Takeaway: Exporting nations experience higher currency demand, boosting value.

1.4 Investor Confidence & Speculation (Market Sentiment Drives Demand)

Why It Affects Demand?

If investors expect a currency to appreciate, they buy more of it.

Safe-haven currencies see increased demand during global uncertainty.

Example:

Gold and the US Dollar (USD) strengthen during economic crises, as investors seek stability.

Brexit uncertainty weakened the British Pound (GBP) as investors speculated on UK economic instability.

Key Takeaway: Market psychology and speculation can drive short-term demand for a currency.

2. Supply Factors in Foreign Exchange (What Increases the Supply of a Currency?)

2.1 Central Bank Monetary Policy (Money Supply & Interest Rate Adjustments)

Why It Affects Supply?

Central banks control currency supply through interest rates and money printing.

Loose monetary policy (low rates, quantitative easing) increases money supply, depreciating currency.

Example:

The European Central Bank (ECB) lowered interest rates and introduced stimulus packages, increasing the supply of Euros (EUR).

The Bank of Japan's low-interest rates increased the supply of Japanese Yen (JPY), making it weaker.

Key Takeaway: More money supply weakens a currency, while tight monetary policy strengthens it.

2.2 Government Debt & Fiscal Policy (Higher Debt Increases Currency Supply)

Why It Affects Supply?

Countries with high national debt may increase money supply to cover obligations.

High debt reduces investor confidence, increasing supply as investors sell off the currency.

Example:

The US dollar saw increased supply during the 2008 financial crisis due to stimulus packages.

Argentina's peso weakened as government debt rose, increasing peso supply in markets.

Key Takeaway: High government debt can lead to more currency supply and depreciation.

2.3 Foreign Exchange Reserves & Currency Intervention (Central Banks Selling Currency to Manage Value)

Why It Affects Supply?

Central banks buy/sell their currency to stabilize exchange rates.

Selling reserves increases currency supply, reducing its value.

Example:

China's central bank occasionally sells Yuan (CNY) to keep it competitive in global markets.

Switzerland's central bank has intervened to weaken the Swiss Franc (CHF) to support exports.

Key Takeaway: Governments manipulate currency supply to stabilize economic conditions.

2.4 Import Demand & Trade Deficits (More Imports Increase Currency Supply)

Why It Affects Supply?

A trade deficit (imports > exports) increases supply of local currency in global markets.

Importers exchange local currency for foreign currency, increasing supply.

Example:

The US has a persistent trade deficit, increasing the supply of US dollars in foreign exchange markets.

The UK's reliance on imports has contributed to GBP fluctuations.

Key Takeaway: Countries with trade deficits see higher currency supply, leading to depreciation.

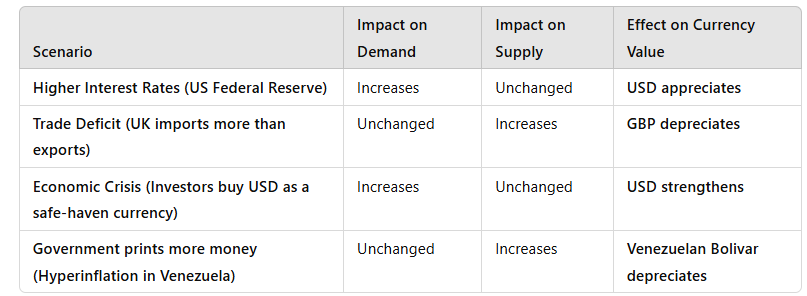

3. Interaction of Supply & Demand in Foreign Exchange Markets

Key Takeaway: Exchange rates fluctuate based on the balance between supply and demand.

4. Conclusion

The foreign exchange market operates based on supply and demand dynamics, influenced by:

Demand Factors:

Interest Rates & Inflation -- Higher rates strengthen demand.

Trade Balances -- Export-driven economies see strong demand.

Investor Sentiment -- Economic stability attracts investors.

Supply Factors:

Central Bank Policies -- Money printing increases supply.

Government Debt -- High debt increases supply, lowering value.

Trade Deficits -- Import-heavy economies see currency depreciation.

Understanding these factors helps businesses and policymakers manage foreign exchange risks and optimize international trade strategies.

Start a Discussions

SIMULATION

XYZ is a large and successful airline which is looking to expand into a new geographical market. It currently offers short haul flights in Europe and wishes to expand into the Asian market. In order to do this, the CFO is considering medium/ long term financing options. Describe 4 options that could be used.

Correct : A

Four Medium/Long-Term Financing Options for XYZ's Expansion into Asia

Introduction

Expanding into a new geographical market requires significant capital investment for new aircraft, operational infrastructure, marketing, and regulatory approvals. As XYZ Airlines plans to enter the Asian market, the CFO must assess medium and long-term financing options to fund this expansion while managing risk and financial stability.

The following are four key financing options that XYZ can consider:

1. Bank Loans (Term Loans)

Definition

A bank term loan is a structured loan from a financial institution with a fixed repayment period (typically 5--20 years), used for large-scale business investments.

Advantages

Predictable repayment structure -- Fixed or floating interest rates over an agreed period.

Retains company ownership -- Unlike equity financing, no shares are sold.

Can be secured or unsecured -- Flexible terms depending on company creditworthiness.

Disadvantages

Requires collateral -- Airlines often secure loans against aircraft or other assets.

Fixed repayment obligations -- Risky if revenue generation is slower than expected.

Interest rate fluctuations -- Increases costs if rates rise (for variable-rate loans).

Example:

British Airways secured bank loans to fund new aircraft purchases.

Best for: Large capital expenditures, such as purchasing aircraft for the new Asian routes.

2. Corporate Bonds

Definition

A corporate bond is a debt security issued to investors, where the company borrows capital and agrees to pay interest (coupon) over time before repaying the principal at maturity (typically 5--30 years).

Advantages

Large capital raise -- Bonds can generate substantial long-term funding.

Lower interest rates than bank loans -- If the company has a strong credit rating.

Flexibility in repayment -- Interest payments (coupons) are pre-agreed, allowing financial planning.

Disadvantages

High creditworthiness required -- Investors demand a solid credit rating.

Fixed interest costs -- Even in poor revenue periods, interest payments must be met.

Long approval and issuance process -- Complex regulatory and underwriting procedures.

Example:

Lufthansa issued corporate bonds to raise capital for fleet expansion.

Best for: Funding fleet expansion or infrastructure development without immediate repayment pressure.

3. Lease Financing (Aircraft Leasing)

Definition

Lease financing involves leasing aircraft instead of purchasing them outright, reducing initial capital expenditure while maintaining operational flexibility.

Advantages

Lower upfront costs -- Avoids large capital outlays.

More flexible than ownership -- Can return or upgrade aircraft as market demand changes.

Preserves cash flow -- Payments are spread over time, aligning with revenue generation.

Disadvantages

Higher long-term costs -- Leasing is more expensive over the aircraft's lifespan compared to ownership.

Limited asset control -- XYZ would not own the aircraft and must follow leasing conditions.

Dependent on lessors' terms -- Strict maintenance and usage clauses.

Example:

Ryanair and Emirates use operating leases to expand their fleets cost-effectively.

Best for: Entering new markets with minimal financial risk, allowing XYZ to test the Asian market before making major capital investments.

4. Equity Financing (Share Issuance)

Definition

Equity financing involves raising funds by issuing new company shares to investors, providing long-term capital without repayment obligations.

Advantages

No repayment burden -- Unlike debt, there are no interest payments or fixed obligations.

Enhances financial stability -- Reduces leverage and improves balance sheet strength.

Can attract strategic investors -- Airlines may raise capital from partners or industry investors.

Disadvantages

Dilutes ownership -- Existing shareholders lose some control.

Time-consuming approval process -- Requires regulatory compliance and investor confidence.

Market dependence -- Success depends on stock market conditions.

Example:

IAG (British Airways' parent company) raised capital via a share issuance to fund expansion.

Best for: Companies looking for long-term funding without increasing debt, especially if stock market conditions are favorable.

5. Comparison of Financing Options

Key Takeaway: Each financing option suits different strategic needs, from ownership-based expansion to flexible leasing.

6. Recommendation: Best Financing Option for XYZ's Expansion

Best Option: Lease Financing (Aircraft Leasing)

Minimizes financial risk while expanding into Asia.

Avoids large upfront costs, preserving cash for operations.

Allows flexibility if the new market underperforms.

Alternative Approach: Hybrid Strategy

Lease aircraft initially Test the Asian market.

Issue corporate bonds later Secure long-term funding for growth.

Consider equity financing if a strategic investor is interested.

Final Takeaway:

A combination of leasing for operational flexibility and corporate bonds or equity for long-term financial strength is the best approach for XYZ's expansion into Asia.

Start a Discussions

SIMULATION

Compare and contrast an aggressive and conservative approach to business funding.

Correct : A

Comparison of Aggressive vs. Conservative Business Funding Approaches

Introduction

Businesses adopt different funding strategies based on their risk tolerance, growth objectives, and financial stability. Two contrasting approaches to business funding are:

Aggressive Funding Approach -- Focuses on high-risk, high-reward strategies with more debt and short-term financing to fuel rapid expansion.

Conservative Funding Approach -- Emphasizes financial stability, risk aversion, and long-term security, often relying on equity and retained earnings to fund operations.

Each approach has advantages and risks, influencing a company's liquidity, cost of capital, and financial sustainability.

1. Aggressive Business Funding Approach (High Risk, High Reward)

Definition

An aggressive funding strategy involves maximizing short-term debt, high leverage, and minimal cash reserves to accelerate growth and expansion.

Key Characteristics:

Relies heavily on debt financing (bank loans, corporate bonds, short-term credit).

Prioritizes rapid growth and high returns over financial security.

Uses minimal equity financing to avoid ownership dilution.

Maintains low cash reserves, assuming cash flows will cover liabilities.

Example:

Startups and tech firms (e.g., Tesla, Uber, Amazon in early years) often borrow aggressively to scale rapidly.

Private equity firms fund acquisitions using high leverage to maximize returns.

Advantages of Aggressive Funding

Faster business expansion -- Capital is readily available for investments.

Higher return potential -- More funds are allocated to revenue-generating activities.

Lower equity dilution -- Existing shareholders maintain control as funding is primarily debt-based.

Disadvantages of Aggressive Funding

High financial risk -- Heavy debt increases vulnerability to economic downturns.

Liquidity problems -- Low cash reserves can cause issues during slow revenue periods.

Higher borrowing costs -- Lenders charge higher interest due to the risk involved.

Best for: Fast-growing companies, high-risk industries, and businesses with predictable cash flows.

2. Conservative Business Funding Approach (Low Risk, Long-Term Stability)

Definition

A conservative funding strategy focuses on low debt levels, high liquidity, and long-term financing to ensure financial stability and steady growth.

Key Characteristics:

Uses retained earnings and equity financing over debt.

Minimizes reliance on short-term credit to avoid financial pressure.

Maintains high cash reserves for financial security.

Focuses on steady, sustainable growth rather than rapid expansion.

Example:

Berkshire Hathaway (Warren Buffett's company) follows a conservative funding model, relying on retained earnings rather than excessive debt.

Family-owned businesses often prioritize financial stability over rapid expansion.

Advantages of Conservative Funding

Lower financial risk -- Reduces dependence on external creditors.

Stable cash flow -- Ensures business continuity during economic downturns.

Better credit rating -- Stronger financial health allows for lower borrowing costs if needed.

Disadvantages of Conservative Funding

Slower business growth -- Limited access to capital can restrict expansion.

Missed market opportunities -- Competitors with aggressive funding may outpace the company.

Higher cost of capital -- Equity financing (selling shares) dilutes ownership and reduces profit per share.

Best for: Established businesses, risk-averse industries, and companies focusing on long-term sustainability.

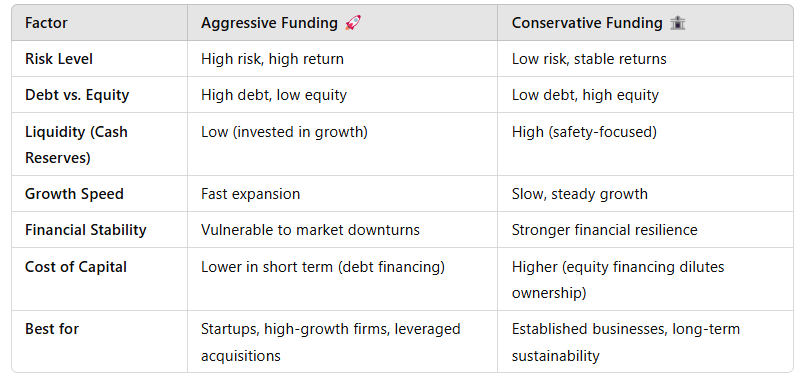

3. Comparison Table: Aggressive vs. Conservative Funding Approaches

Key Takeaway: The best funding approach depends on industry, company stage, and risk appetite.

4. Which Approach Should a Business Use?

Aggressive Approach is Ideal For:

Startups & High-Growth Companies -- Need fast capital to capture market share.

Businesses in Competitive Markets -- Companies that must outpace rivals through aggressive expansion.

Private Equity & Leveraged Buyouts -- Maximizing returns through high debt strategies.

Conservative Approach is Ideal For:

Mature & Stable Businesses -- Companies prioritizing steady revenue and financial security.

Family-Owned Enterprises -- Owners prefer low debt and long-term growth.

Risk-Averse Industries -- Businesses in essential goods/services sectors where stability is more important than rapid expansion.

Hybrid Approach: The Best of Both Worlds?

Many businesses use a combination of both approaches, leveraging debt for growth while maintaining financial stability through retained earnings and equity.

Example:

Apple used a conservative strategy in its early years but adopted aggressive funding for global expansion post-2010.

5. Conclusion

The choice between aggressive and conservative funding depends on a company's growth goals, financial risk tolerance, and industry conditions.

Aggressive funding maximizes short-term growth but increases financial risk.

Conservative funding ensures stability but limits expansion speed.

Most companies use a hybrid model to balance growth and financial security.

Understanding these approaches helps businesses optimize capital structure, manage risk, and align financing with strategic objectives.

Start a Discussions

SIMULATION

Organisations in the private sector often need to make decisions regarding financing, investment and dividends. Discuss factors that affect these decisions.

Correct : A

Factors Affecting Financing, Investment, and Dividend Decisions in Private Sector Organizations

Introduction

Private sector organizations must carefully balance financing, investment, and dividend decisions to ensure financial stability, profitability, and shareholder satisfaction. These decisions are influenced by internal financial health, external economic conditions, market competition, and regulatory requirements.

This answer examines the key factors affecting financing, investment, and dividend policies in private sector companies.

1. Factors Affecting Financing Decisions (How Companies Raise Capital?)

Financing decisions determine how businesses fund operations, expansion, and debt repayment.

1.1 Cost of Capital (Debt vs. Equity Considerations)

Why It Matters?

Companies choose between debt financing (bank loans, bonds) and equity financing (selling shares) based on the cost of capital.

Higher interest rates make debt financing expensive, while equity financing dilutes ownership.

Example:

A startup may prefer equity financing to avoid immediate debt repayments.

A profitable company may use debt due to tax advantages on interest payments.

Key Takeaway: Companies aim to minimize capital costs while maintaining financial flexibility.

1.2 Company's Creditworthiness & Risk Tolerance

Why It Matters?

Stronger credit ratings allow companies to secure loans at lower interest rates.

Riskier businesses may struggle to secure financing or face high borrowing costs.

Example:

Apple can easily issue corporate bonds due to its strong financial position.

A high-risk startup may have to offer higher interest rates on its debt.

Key Takeaway: Financially stable firms have more funding options at lower costs.

1.3 Economic Conditions (Market Trends & Inflation)

Why It Matters?

In economic downturns, companies avoid excessive borrowing.

Inflation and interest rate hikes increase financing costs.

Example:

During recessions, companies reduce borrowing to avoid high debt risks.

In a booming economy, firms take loans to expand production and capture market share.

Key Takeaway: Businesses adjust financing strategies based on economic stability and interest rates.

2. Factors Affecting Investment Decisions (Where and How Companies Invest Capital?)

2.1 Expected Return on Investment (ROI)

Why It Matters?

Companies evaluate potential profits from investments before committing capital.

High-ROI projects are prioritized, while low-ROI investments are avoided.

Example:

Tesla invests in battery technology due to high future demand.

A retail chain avoids investing in struggling markets with low profitability.

Key Takeaway: Businesses prioritize high-return investments that align with strategic goals.

2.2 Risk Assessment & Diversification

Why It Matters?

Companies assess market, operational, and financial risks before investing.

Diversification reduces reliance on a single revenue source.

Example:

Amazon diversified into cloud computing (AWS) to reduce dependence on e-commerce sales.

Oil companies invest in renewable energy to hedge against declining fossil fuel demand.

Key Takeaway: Investment decisions focus on balancing risk and opportunity.

2.3 Availability of Internal Funds vs. External Borrowing

Why It Matters?

Companies use retained earnings when available to avoid debt costs.

When internal funds are insufficient, they borrow or raise equity capital.

Example:

Google reinvests profits into AI and software development instead of taking loans.

A new airline expansion may require debt financing for aircraft purchases.

Key Takeaway: Investment decisions depend on fund availability and cost considerations.

3. Factors Affecting Dividend Decisions (How Companies Distribute Profits to Shareholders?)

3.1 Profitability & Cash Flow Stability

Why It Matters?

Profitable companies pay higher dividends, while struggling firms reduce payouts.

Strong cash flow ensures consistent dividend payments.

Example:

Microsoft pays regular dividends due to its steady revenue stream.

A startup reinvests all profits into business growth instead of paying dividends.

Key Takeaway: Only profitable, cash-rich companies sustain high dividend payouts.

3.2 Growth vs. Payout Trade-Off

Why It Matters?

High-growth firms reinvest profits for expansion instead of paying high dividends.

Mature companies with stable profits focus on rewarding shareholders.

Example:

Amazon reinvests heavily in logistics and AI rather than paying high dividends.

Coca-Cola pays consistent dividends as its industry growth is slower.

Key Takeaway: Companies balance growth investment and shareholder returns.

3.3 Shareholder Expectations & Market Perception

Why It Matters?

Investors expect dividends, especially in blue-chip and income-focused stocks.

Sudden dividend cuts can signal financial trouble, affecting share prices.

Example:

Unilever maintains stable dividends to attract income-focused investors.

Tesla does not pay dividends, focusing on long-term growth and innovation.

Key Takeaway: Dividend policies affect investor confidence and stock valuation.

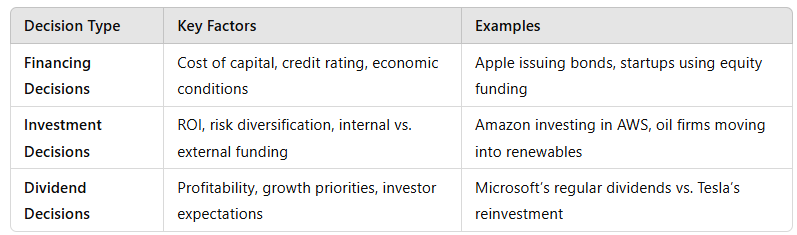

4. Summary: Key Factors Influencing Financial Decisions

Key Takeaway: Companies balance financing, investment, and dividend decisions based on profitability, risk assessment, and market conditions.

5. Conclusion

Private sector companies make strategic financial decisions by evaluating:

Financing Needs: Debt vs. equity, cost of borrowing, and risk management.

Investment Priorities: Expected ROI, business growth, and market opportunities.

Dividend Strategy: Balancing shareholder returns and reinvestment for growth.

Understanding these factors helps businesses maximize financial performance, shareholder value, and long-term sustainability.

Start a Discussions

SIMULATION

Provide a definition of a commodity product. What role does speculation and hedging play in the commodities market?

Correct : A

Commodity Products and the Role of Speculation & Hedging in the Commodities Market

1. Definition of a Commodity Product

A commodity product is a raw material or primary agricultural product that is uniform in quality and interchangeable with other products of the same type, regardless of the producer.

Key Characteristics:

Standardized and homogeneous -- Little differentiation between producers.

Traded on global markets -- Bought and sold on commodity exchanges.

Price determined by supply & demand -- Subject to market fluctuations.

Examples of Commodity Products:

Agricultural Commodities -- Wheat, corn, coffee, cotton.

Energy Commodities -- Crude oil, natural gas, coal.

Metals & Minerals -- Gold, silver, copper, aluminum.

Key Takeaway: Commodities are essential goods used in global trade, where price is the primary competitive factor.

2. The Role of Speculation in the Commodities Market

Definition

Speculation involves buying and selling commodities for profit rather than for actual use, based on price predictions.

How Speculation Works:

Traders and investors buy commodities expecting price increases (long positions).

They sell commodities expecting price declines (short positions).

No physical exchange of goods---transactions are purely financial.

Example:

A trader buys crude oil futures at $70 per barrel, expecting prices to rise. If oil reaches $80 per barrel, the trader sells for profit.

Advantages of Speculation

Increases market liquidity -- More buyers and sellers improve trading efficiency.

Enhances price discovery -- Helps determine fair market value.

Absorbs market risk -- Speculators take risks that producers or consumers avoid.

Disadvantages of Speculation

Creates excessive volatility -- Large speculative trades can cause price spikes or crashes.

Detaches prices from real supply and demand -- Can inflate bubbles or cause artificial declines.

Market manipulation risks -- Speculators with large holdings can distort prices.

Key Takeaway: Speculation adds liquidity and helps price discovery, but can lead to extreme volatility if unchecked.

3. The Role of Hedging in the Commodities Market

Definition

Hedging is a risk management strategy used by commodity producers and consumers to protect against price fluctuations.

How Hedging Works:

Producers (e.g., farmers, oil companies) use futures contracts to lock in a price for future sales, reducing the risk of price drops.

Consumers (e.g., airlines, food manufacturers) hedge to secure stable input costs, avoiding sudden price surges.

Example:

An airline hedges against rising fuel costs by buying fuel futures at a fixed price for the next 12 months. If fuel prices rise, the airline is protected from increased expenses.

Advantages of Hedging

Stabilizes revenue and costs -- Helps businesses plan with certainty.

Protects against price swings -- Reduces exposure to unpredictable market conditions.

Encourages long-term investment -- Producers and buyers operate with confidence.

Disadvantages of Hedging

Reduces potential profits -- If prices move favorably, hedgers miss out on gains.

Contract obligations -- Hedgers must honor contract terms, even if market prices improve.

Hedging costs -- Fees and contract costs can be high.

Key Takeaway: Hedging protects businesses from commodity price risk, ensuring stable revenue and cost control.

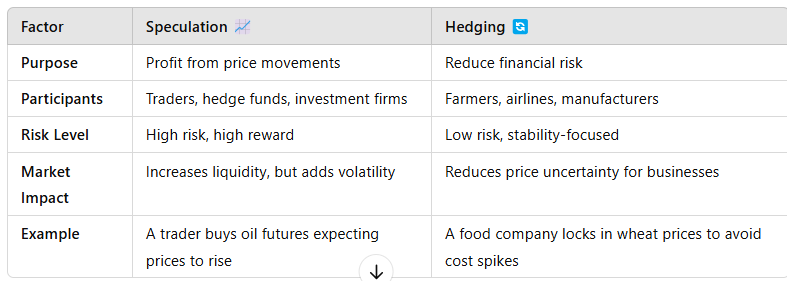

4. Speculation vs. Hedging: Key Differences

Key Takeaway: Speculation seeks profit from price changes, while hedging minimizes risk from price fluctuations.

5. Conclusion

Commodity products are standardized raw materials traded globally, with prices driven by supply and demand dynamics.

Speculation brings liquidity and price discovery but can increase volatility.

Hedging helps businesses stabilize costs and revenues, ensuring financial predictability.

Both strategies play essential roles in ensuring a balanced, functional commodities market.

Start a Discussions

Total 40 questions