Curious about Actual CIMA Professional Qualification (CIMAPRA19-F03-1) Exam Questions?

Here are sample CIMA F3 Financial Strategy (CIMAPRA19-F03-1) Exam questions from real exam. You can get more CIMA Professional Qualification (CIMAPRA19-F03-1) Exam premium practice questions at TestInsights.

Company WWW is identical in all operating and risk characteristics to Company ZZZ. but their capital structures differ. Company WWW and Company ZZZ both pay corporate income tax at 20%

Company WWW has a gearing ratio (debt: equity) of 1:3 Its pre-tax cost of debt is 6%.

Company ZZZ Is all-equity financed. Its cost of equity is 15%

What is the cost of equity tor Company WWW?

Correct : A

Start a Discussions

Which THREE of the following would be of most interest to lenders deciding whether to provide long-term debt to a company?

Correct : A, B, E

Start a Discussions

Country X's short-term interest rates are slightly higher than its long-term rates. Which THREE of the following statements are correct?

Correct : A, B, E

Start a Discussions

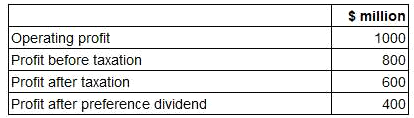

Extracts from a company's profit forecast for the next financial year is as follows:

Since preparing the forecast, the company has decided to return surplus cash to shareholders by a share repurchase arrangement.

The share repurchase would result in the company purchasing 20% of the 2,000 million ordinary shares currently in issue and cancelling them.

Assuming the share repurchase went ahead, the impact on the company's forecast earnings per share will be an increase of:

Correct : A

Start a Discussions

NNN is a company financed by both equity and debt. The directors of NNN wish to calculate a valuation of the company's equity and at a recent board meeting discussed various methods of business valuation.

Which THREE of the following are appropriate methods for the directors of NNN to use in this instance?

Correct : A, B, E

Start a Discussions

Total 391 questions