Curious about Actual CIMA Professional Qualification (CIMAPRA19-F01-1) Exam Questions?

Here are sample CIMA F1 Financial Reporting (CIMAPRA19-F01-1) Exam questions from real exam. You can get more CIMA Professional Qualification (CIMAPRA19-F01-1) Exam premium practice questions at TestInsights.

Which of the following is an effect of using equity accounting to include an entity in the consolidated statement of financial position of a group?

Correct : A

Start a Discussions

Which of the following is correct?

The primary purpose of a cash budget prepared on a monthly basis is to determine:

Correct : D

Start a Discussions

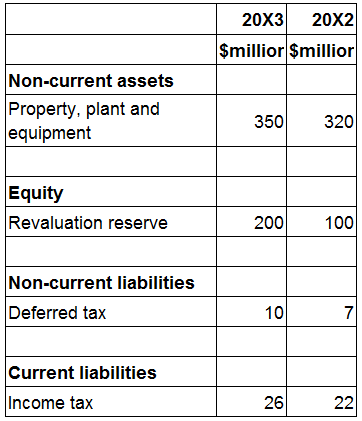

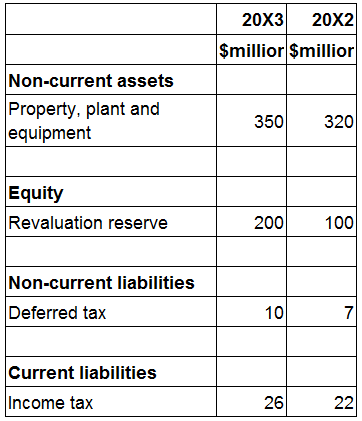

The following information is extracted from the statement of financial position for ZZ at 31 March 20X3:

Included within cost of sales in the statement of profit or loss for the year ended 31 March 20X3 is $20 million relating to the loss on the sale of plant and equipment which had cost $100 million in June 20X1.

Depreciation is charged on all plant and equipment at 25% on a straight line basis with a full year's depreciation charged in the year of acquisition and none in the year of sale.

The revaluation reserve relates to the revaluation of ZZ's property.

The total depreciation charge for property, plant and equipment in ZZ's statement of profit of loss for the year ended 31 March 20X3 is $80 million.

The corporate income tax expense in ZZ's statement of profit or loss for year ended 31 March 20X3 is $28 million.

ZZ is preparing its statement of cash flows for the year ended 31 March 20X3.

What figure should be included within cash flows from investing activities for the proceeds of sale of plant and equipment?

Correct : A

Start a Discussions

The following information is extracted from the statement of financial position for ZZ at 31 March 20X3:

Included within cost of sales in the statement of profit or loss for the year ended 31 March 20X3 is $20 million relating to the loss on the sale of plant and equipment which had cost $100 million in June 20X1.

Depreciation is charged on all plant and equipment at 25% on a straight line basis with a full year's depreciation charged in the year of acquisition and none in the year of sale.

The revaluation reserve relates to the revaluation of ZZ's property.

The total depreciation charge for property, plant and equipment in ZZ's statement of profit of loss for the year ended 31 March 20X3 is $80 million.

The corporate income tax expense in ZZ's statement of profit or loss for year ended 31 March 20X3 is $28 million.

ZZ is preparing its statement of cash flows for the year ended 31 March 20X3.

What cash outflow figure should be included within cash flows from investing activities for the purchase of property, plant and equipment?

Correct : A

Start a Discussions

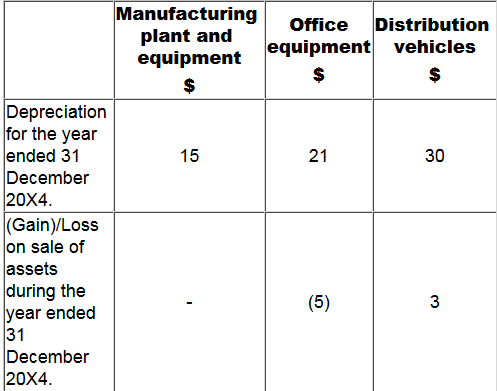

The following information relates to AA.

Extract of Trial Balance at 31 December 20X4;

Notes

(i) Inventory at 31 December 20X4 was valued at cost at $30.

(ii) The loan which was received on 1 July 20X4 is repayable in 20X9.

(iii) Corporate income tax represents an over-provision of tax for the year ended 31 December 20X3. AA reported a loss for tax purposes for the year ended 31 December 20X4 and a tax refund is expected amounting to $20.

(iv) Cost of sales, administration and distribution costs need to be adjusted for the following:

What figures should be entered on the face of the Statement of profit or Loss for the year ended 31 December 20X4 in relation to Interest and Corporate income tax?

Correct : A

Start a Discussions

Total 177 questions