Curious about Actual CFA Institute CFA Level II Chartered Financial Analyst Exam Questions?

Here are sample CFA Institute CFA Level II Chartered Financial Analyst (CFA-Level-II) Exam questions from real exam. You can get more CFA Institute CFA Level II (CFA-Level-II) Exam premium practice questions at TestInsights.

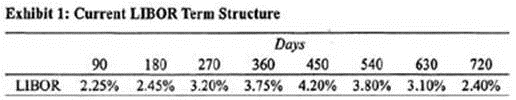

William Bow, CFA, is a risk manager for GlobeCorp, an international conglomerate with operations in the technology, consumer products, and medical devices industries. Exactly one year ago, GlobeCorp, under Bow's advice, entered into a 3-year payer interest rate swap with semiannual floating rate payments based on the London interbank offered rate (LIBOR) and semiannual fixed rate payments based on an annual rate of 2.75%. At the time of initiation, the swap had a value of zero and the notional principal was set equal to $150 million. The counterparty to GlobeCorp's swap is NVS Bank, a commercial bank that also serves as a swap dealer. Exhibit 1 below summarizes the current LIBOR term structure.

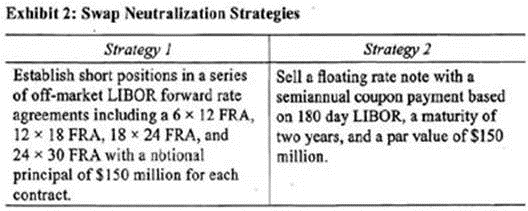

Upper management at GlobeCorp feels that the original swap has served its intended purpose but that circumstances have changed and it is now time to offset the firm's exposure to the swap. Because they cannot find a counterparty to an offsetting swap transaction, management has asked Bow to come up with alternative measures to offset the swap exposure. Bow created a report for the management team which outlines several strategies to neutralize the swap exposure. Two of his strategies are included in Exhibit 2.

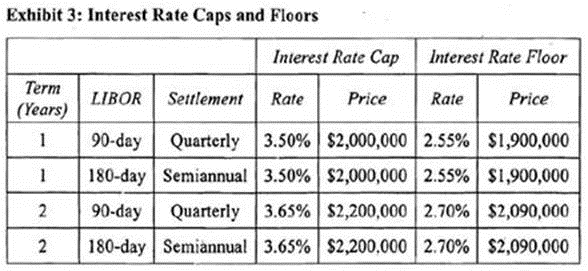

After examining its long-term liabilities, NVS Bank has decided that it currently needs to borrow $100 million over the next two years to finance its operations. For this type of funding need, NVS generally issues quarterly coupon short-term floating rate notes based on 90-day LIBOR. NVS is concerned, however, that interest rates may shift upward and the LIBOR curve may become upward sloping. To manage this risk, NVS is considering utilizing interest rate derivatives. Managers at the bank have collected quotes on over-the-counter interest rate caps and floors from a well known securities dealer. The quotes, which are based on a notional principal of $100 million, are provided in Exhibit 3.

One of the managers at NVS Bank, Lois Green, has expressed her distrust of the securities dealer quoting prices on the caps and floors. In a memo to the CFO, Green suggested that NVS use an alternative but equivalent approach to manage the interest rate risk associated with its two-year funding plan. Following is an excerpt from Green's memo:

"Rather than using a cap or floor, NVS Bank can effectively manage its exposure to interest rates resulting from the 2-year funding requirement by taking long positions in a series of put options on fixed-income instruments with expiration dates that coincide with the payment dates on the floating rate note."

"As a cheaper alternative, NVS can effectively manage its exposure to interest rates resulting from the 2-ycar funding requirement by creating a collar using long positions in a series of call options on interest rates and long positions in a series of call options on fixed income instruments all of which would have expiration dates that coincide with the payment dates on the floating rate note."

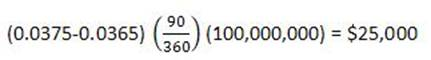

Determine which of the interest rate derivatives in Exhibit 3 is appropriate to manage the interest rate risk associated with NVS Bank's $100 million debt obligation and calculate the payoff from this derivative 360 days after the contract initiation if LIBOR at that time is expected to be 3.75%.

Correct : A

NVS Banks is issuing a $100 million floating rate note with quarterly interest rate payments and a maturity of two years to fund its operations. The interest rate risk of such a measure is that interest rates will rise dramatically causing the interest cost on the floating rate note to increase as well. To offset this risk, NVS Bank can take a long position in an interest rate cap. If interest rates rise, the counterparty to the cap will make a payment to NVS Bank. If interest rates fall, no payment is made. Since the cap is a set of interest rate options, NVS has the right to receive payments if the cap is in the money but will never owe any payments if the cap is out of the money. To obtain this option, NVS must pay the cap premium ($2,200,000). The most appropriate cap is the 2-year quarterly payment cap with a contract rate of 3.65%. The expected payoff after 360 days is determined by comparing the expected LIBOR rate (3.75%) to the contract rate on the cap (3.65%). Since the actual rate is expected to be above the cap rate, the cap is in the money and the payoff is calculated as follows:

(Study Session 17, LOS 62.a,b)

Start a Discussions

Michelle Norris, CFA, manages assets for individual investors in the United States as well as in other countries. Norris limits the scope of her practice to equity securities traded on U .S . stock exchanges. Her partner, John Witkowski, handles any requests for international securities. Recently, one of Norris's wealthiest clients suffered a substantial decline in the value of his international portfolio. Worried that his U .S . allocation might suffer the same fate, he has asked Norris to implement a hedge on his portfolio. Norris has agreed to her client's request and is currently in the process of evaluating several futures contracts. Her primary interest is in a futures contract on a broad equity index that will expire 240 days from today. The closing price as of yesterday, January 17, for the equity index was 1,050. The expected dividends from the index yield 2% (continuously compounded annual rate). The effective annual risk-free rate is 4.0811%, and the term structure is flat. Norris decides that this equity index futures contract is the appropriate hedge for her client's portfolio and enters into the contract.

Upon entering into the contract, Norris makes the following comment to her client:

"You should note that since we have taken a short position in the futures contract, the price we will receive for selling the equity index in 240 days will be reduced by the convenience yield associated with having a long position in the underlying asset. If there were no cash flows associated with the underlying asset, the price would be higher. Additionally, you should note that if we had entered into a forward contract with the same terms, the contract price would most likely have been lower but we would have increased the credit risk exposure of the portfolio."

Sixty days after entering into the futures contract, the equity index reached a level of 1,015. The futures contract that Norris purchased is now trading on the Chicago Mercantile Exchange for a price of 1,035. Interest rates have not changed. After performing some calculations, Norris calls her client to let him know of an arbitrage opportunity related to his futures position. Over the phone, Norris makes the following comments to her client:

"We have an excellent opportunity to earn a riskless profit by engaging in arbitrage using the equity index, risk-free assets, and futures contracts. My recommended strategy is as follows: We should sell the equity index short, buy the futures contract, and pay any dividends occurring over the life of the contract. By pursuing this strategy, we can generate profits for your portfolio without incurring any risk."

Which of the following best describes the movement of the futures price on the 240-day equity index futures contract as the contract moves toward the expiration date?

Correct : C

The futures price for a given contract maturity must converge to the spot price as the contract moves toward expiration. Otherwise, arbitrage opportunities would exist. (Study Session 16, LOS 59.a)

Start a Discussions

James Walker is the Chief Financial Officer for Lothar Corporation, a U .S . mining company that specializes in worldwide exploration for and excavation of precious metals. Lothar Corporation generally tries to maintain a debt-to-capital ratio of approximately 45% and has successfully done so for the past seven years. Due to the time lag between the discovery of an extractable vein of metal and the eventual sale of the excavated material, the company frequently must issue short-term debt to fund its operations. Issuing these one to six month notes sometimes pushes Lothar's debt to capital ratio above their long-term target, but the cash provided from the short-term financing is necessary to complete the majority of the company's mining projects.

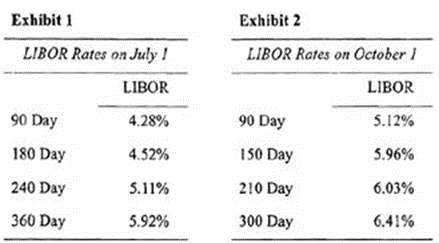

Walker has estimated that extraction of silver deposits in southern Australia has eight months until project completion. However, funding for the project will run out in approximately six months. In order to cover the funding gap. Walker will have to issue short-term notes with a principal value of $1,275,000 at an unknown future interest rate. To mitigate the interest rate uncertainty, Walker has decided to enter into a forward rate agreement (FRA) based on LIBOR which currently has a term structure as shown in Exhibit 1.

Three months after establishing the position in the forward rate agreement, LIBOR interest rates have shifted causing the value of Lothar's FRA . position to change as well. The new LIBOR term structure is shown in Exhibit 2.

While Walker is estimating the change in the value of the original FRA position, he receives a memo from the Chief Operating Officer of Lochar Corporation, Maria Steiner, informing him of a major delay in one of the company's South African mining projects. In the memo, Stciner states the following: "As usual, the project delay will require a short-term loan to cover funding shortage that will accompany the extra time until project completion. I have estimated that in 210 days, we will require a 90-day project loan in the amount of $2,350,000.1 would like you to establish another FRA position, this time with a contract rate of 6.95%."

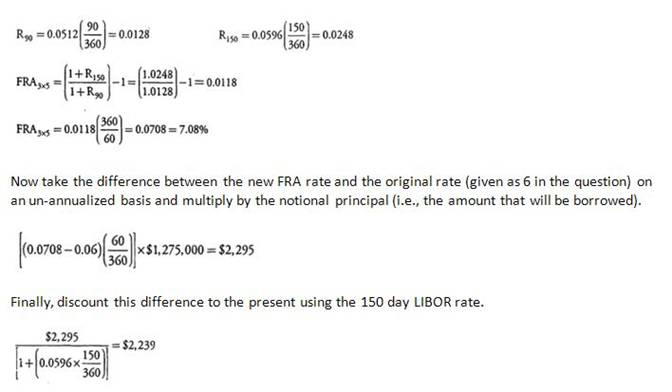

Which of the following is closest to the value of the forward rate agreement three months after the inception of the contract (from Walker's perspective)? For this question only, assume that the interest rate at inception was 6.0%.

Correct : A

For this question, we must find the value of the FRA 3 months or 90 days after the inception of the contract. First find the contract rate on a new FRA . Since we are 90 days past the inception of the original contract an equivalent new contract would be a 3 x 5 FRA, which would represent a 2 month (60 day) loan that would begin three months (90 days) from now. Thus, the relevant LIBOR rates are going to be 90-day and 150-day LIBOR. Calculate the FRA rate the same way as in the previous question:

(Study Session 16,105 58.0)

Start a Discussions

James Walker is the Chief Financial Officer for Lothar Corporation, a U .S . mining company that specializes in worldwide exploration for and excavation of precious metals. Lothar Corporation generally tries to maintain a debt-to-capital ratio of approximately 45% and has successfully done so for the past seven years. Due to the time lag between the discovery of an extractable vein of metal and the eventual sale of the excavated material, the company frequently must issue short-term debt to fund its operations. Issuing these one to six month notes sometimes pushes Lothar's debt to capital ratio above their long-term target, but the cash provided from the short-term financing is necessary to complete the majority of the company's mining projects.

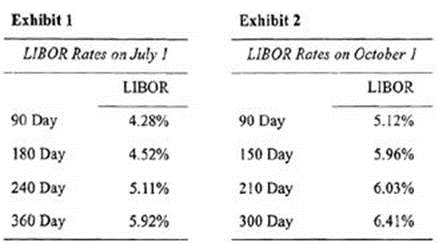

Walker has estimated that extraction of silver deposits in southern Australia has eight months until project completion. However, funding for the project will run out in approximately six months. In order to cover the funding gap. Walker will have to issue short-term notes with a principal value of $1,275,000 at an unknown future interest rate. To mitigate the interest rate uncertainty, Walker has decided to enter into a forward rate agreement (FRA) based on LIBOR which currently has a term structure as shown in Exhibit 1.

Three months after establishing the position in the forward rate agreement, LIBOR interest rates have shifted causing the value of Lothar's FRA . position to change as well. The new LIBOR term structure is shown in Exhibit 2.

While Walker is estimating the change in the value of the original FRA position, he receives a memo from the Chief Operating Officer of Lochar Corporation, Maria Steiner, informing him of a major delay in one of the company's South African mining projects. In the memo, Stciner states the following: "As usual, the project delay will require a short-term loan to cover funding shortage that will accompany the extra time until project completion. I have estimated that in 210 days, we will require a 90-day project loan in the amount of $2,350,000.1 would like you to establish another FRA position, this time with a contract rate of 6.95%."

Which of the following statements regarding the credit risk associated with Walker's original FRA contract three months after the inception of the contract is least accurate?

Correct : B

In forward markets, there is no clearinghouse. Forward contracts are between two private entities, and as such, rhe credit risk is borne by the part)* with a positive contract position. In Walker's case, since the contract has positive value three months after inception, he is exposed to the risk that the short position will be unable to make the required payment at the contract expiration. This problem could be alleviated through periodically marking the contract to market. Mark-to-market features are not common to ail forward contracts but can be included if so desired by the parties entering into the contract. (Study Session 16, LOS 58.d)

Start a Discussions

James Walker is the Chief Financial Officer for Lothar Corporation, a U .S . mining company that specializes in worldwide exploration for and excavation of precious metals. Lothar Corporation generally tries to maintain a debt-to-capital ratio of approximately 45% and has successfully done so for the past seven years. Due to the time lag between the discovery of an extractable vein of metal and the eventual sale of the excavated material, the company frequently must issue short-term debt to fund its operations. Issuing these one to six month notes sometimes pushes Lothar's debt to capital ratio above their long-term target, but the cash provided from the short-term financing is necessary to complete the majority of the company's mining projects.

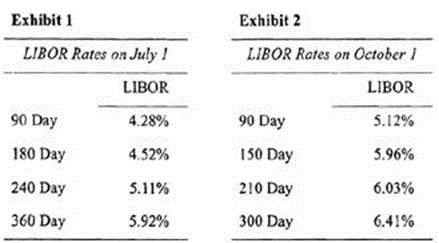

Walker has estimated that extraction of silver deposits in southern Australia has eight months until project completion. However, funding for the project will run out in approximately six months. In order to cover the funding gap. Walker will have to issue short-term notes with a principal value of $1,275,000 at an unknown future interest rate. To mitigate the interest rate uncertainty, Walker has decided to enter into a forward rate agreement (FRA) based on LIBOR which currently has a term structure as shown in Exhibit 1.

Three months after establishing the position in the forward rate agreement, LIBOR interest rates have shifted causing the value of Lothar's FRA . position to change as well. The new LIBOR term structure is shown in Exhibit 2.

While Walker is estimating the change in the value of the original FRA position, he receives a memo from the Chief Operating Officer of Lochar Corporation, Maria Steiner, informing him of a major delay in one of the company's South African mining projects. In the memo, Stciner states the following: "As usual, the project delay will require a short-term loan to cover funding shortage that will accompany the extra time until project completion. I have estimated that in 210 days, we will require a 90-day project loan in the amount of $2,350,000.1 would like you to establish another FRA position, this time with a contract rate of 6.95%."

When the silver is removed from ihe mine, it will be sold to an Australian subsidiary before being exported. Walker is concerned that the price of silver and the Australian dollar will both depreciate over the next eight months. Which of the following strategies will be most appropriate given Walker's expectations? Hstablish a:

Correct : C

The company will need to sell silver in eight months. Thus, if the price of silver is expected to fall over that time frame, Walker should be short a forward contract on the price of silver to lock in a higher selling price now. Walker will also need to convert Australian dollars to U .S . dollars after the extracted Australian silver is sold. Thus, he is effectively Jong Australian dollars and will need either a short currency forward contract on Australian dollars or equivalently a long currency forward contract on U .S . dollars if he expects the Australian dollar to depreciate. (Study Session 16, LOS 58.a)

Start a Discussions

Total 715 questions