Curious about Actual APA Fundamental Payroll (FPC-Remote) Exam Questions?

Here are sample APA Fundamental Payroll Certification (FPC-Remote) Exam questions from real exam. You can get more APA Fundamental Payroll (FPC-Remote) Exam premium practice questions at TestInsights.

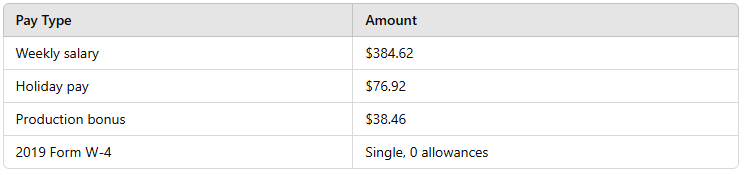

Using the percentage method for automated payroll systems, calculate the federal income tax withholding based on the following information:

Correct : C

Total taxable wages: $384.62 + $76.92 + $38.46 = $500.00

Using IRS percentage method tables, withholding = $39.04

IRS Publication 15-T (Tax Withholding Tables)

Start a Discussions

Payroll system security violations may result in:

Correct : B

Unauthorized access (B) is a direct result of security breaches.

Other options (A, C, D) may result from human error but not security violations.

Payroll Security Guidelines (Payroll.org)

Start a Discussions

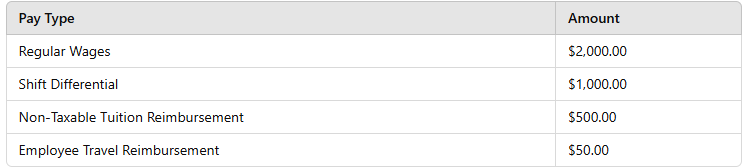

Using the following information, calculate the employer's total FICA tax liability for the first payroll of the year.

Correct : A

Step 1: Determine taxable wages

Regular wages: $2,000.00

Shift differential: $1,000.00

Total taxable wages = $3,000.00 (Non-taxable tuition reimbursement and travel are excluded.)

Step 2: Calculate Social Security tax

$3,000 6.2% = $186.00 (Employer portion)

Step 3: Calculate Medicare tax

$3,000 1.45% = $43.50 (Employer portion)

Step 4: Total employer FICA tax

Social Security + Medicare = $186.00 + $43.50 = $229.50

Employer's share = $229.50 2 = $459.00

IRS Publication 15 (Employer's Tax Guide)

Social Security and Medicare Tax Rates (IRS)

Start a Discussions

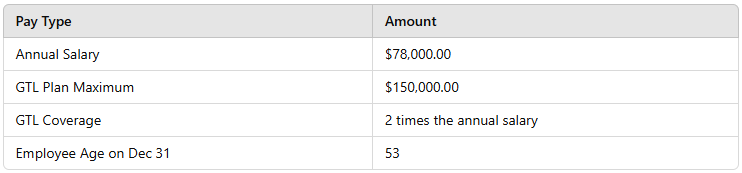

Using the following information, calculate the imputed income that MUST be included in the employee's monthly gross pay.

Correct : C

Step 1: Calculate excess GTL coverage

Employee GTL coverage = $78,000 2 = $156,000

Excludable amount = $50,000

Taxable excess = $156,000 - $50,000 = $106,000

Step 2: Use IRS Table for GTL Taxable Rates (for age 53: $0.23 per $1,000 of coverage)

$106 $0.23 = $24.38 per month

IRS Publication 15-B (Taxable Group Term Life Insurance)

Start a Discussions

Employer's federal quarterly employment taxes are reported on:

Correct : B

Form 941 is used to report quarterly employment taxes (including federal income tax, Social Security, and Medicare).

Form 940 reports FUTA taxes (A), not quarterly employment taxes.

Form 944 is for small employers who file annually instead of quarterly.

Form 945 is for non-wage income withholding (D).

IRS Form 941 Instructions

Start a Discussions

Total 162 questions