Curious about Actual AAFM Chartered Wealth Manager (GLO_CWM_LVL_1) Exam Questions?

Here are sample AAFM Chartered Wealth Manager (CWM) Global ination (GLO_CWM_LVL_1) Exam questions from real exam. You can get more AAFM Chartered Wealth Manager (GLO_CWM_LVL_1) Exam premium practice questions at TestInsights.

Mr. John purchased a house in Mumbai in March 2010 for Rs.12,50,000. In April,2011 he entered into an agreement to sell the property to Mr. Akram for a consideration of Rs.19,75,000 and received earnest money of Rs. 50,000. As per the terms of the agreement, the balance payment was to be made within 30 days of the agreement. If the intending purchaser does not make the payment within 30 days, the earnest money would be forfeited. As Mr. Akram could not make the payment within the stipulated time the amount of Rs.50000 was forfeited by John. Subsequently John sold the house in June, 2011 for Rs.2130000. He paid 2% brokerage on sale of the house. Calculate the capital gains chargeable to tax for the assessment year 2012-13. [CII-12-13: 852,11-12: 785,10-11:711]

Correct : B

Start a Discussions

If a scheme has 45 cr units issued and has a Face Value of Rs. 10 and NAV is at 11.13, unit capital (Rs. Cr) would be equal to

Correct : D

Start a Discussions

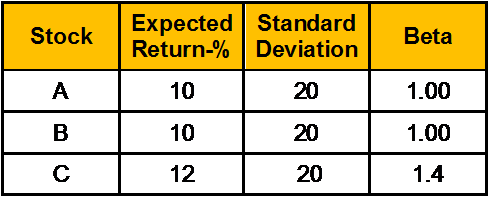

Consider the following information for three stocks, Stock A, Stock B, and Stock C. The returns on each of the three stocks are positively correlated, but they are not perfectly correlated.

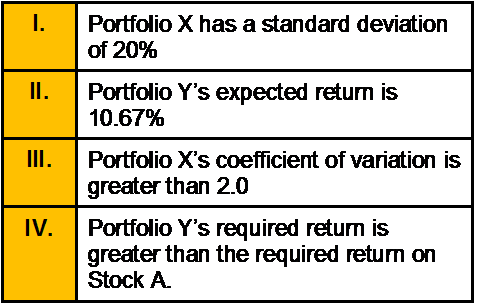

Portfolio X has half of its funds invested in Stock A and half invested in Stock B. Portfolio Y has invested its funds equally in each of the three stocks. The risk-free rate is 5%, and the market is in equilibrium.

Which of the following statements is/are correct?

Correct : B

Start a Discussions

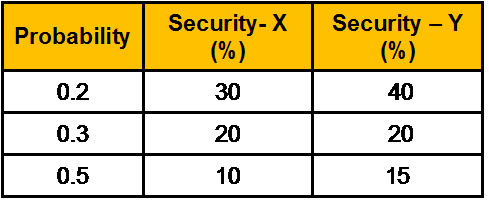

Calculate expected rate of return on the following portfolio?

Weight of X and Y in the portfolio is 50% and 50% respectively.

Correct : A

Start a Discussions

You want to take a trip overseas which costs Rs. 10 lacs. The cost is expected to remain unchanged in nominal terms. You can save annually Rs. 50000 to fulfill the desire. How long will you have to wait if your savings earn an interest rate of 12%?

Correct : A

Start a Discussions

Total 1057 questions