Curious about Actual AAFM Chartered Wealth Manager (CWM_LEVEL_2) Exam Questions?

Here are sample AAFM Chartered Wealth Manager (CWM) Certification Level II ination (CWM_LEVEL_2) Exam questions from real exam. You can get more AAFM Chartered Wealth Manager (CWM_LEVEL_2) Exam premium practice questions at TestInsights.

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Mehta buys machinery for Rs. 80000 which is to be replaced after a period of two years. The replacement cost at that time will be Rs. 90000. As a Chartered Wealth Manager advice Mr. Mehta now what he should do after two year for the replacement of the said machinery?

Correct : A

Start a Discussions

Section C (4 Mark)

Read the senario and answer to the question.

During identification of new business opportunities, one of Harish's friends Shekhar has offered him a business proposal. In this proposal a partnership firm consisting of two partners, Harish and Shekhar, shall take the franchise of a company which is a reputed brand in the field of pathology lab in which their investment and profit sharing ratio shall be equal.

Franchise rights shall be valid for 5 years and the project requires an upfront investment of Rs. 25 lakh for required infrastructure. The franchisee agreement has an option that the company can take over the franchisee after 5 years by charging depreciation @15% p.a. on straight line basis.

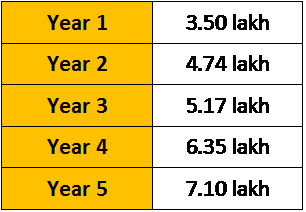

The projected profits from the firm are as follows:

Harish wants to know what IRR he will earn on his investment from this project ? (Please ignore taxes and assuming no additional investment is made during this five year period)

Correct : A

Start a Discussions

Section C (4 Mark)

Read the senario and answer to the question.

Mr. Saxena is planning to visit USA for the very first time in his carrier to promote software of his company and is expected to stay long. He wants to plan his journey in such a manner so that he can get maximum tax benefits in the FY 2007--08 from the residential status point of view. What is the latest date when he can afford to leave India & earn status of an NRI to get maximum tax benefits in assessment year 2008--09?

Correct : B

Start a Discussions

Section C (4 Mark)

Read the senario and answer to the question.

Harish wants a monthly investment to achieve the goal of his children's higher education. For accumulation of fund you recommend Harish to invest in an investment vehicle which invests in the ratio of 20:80 in Debt and Equity. If Harish starts investing from 1st Dec 2010, what approximate amount should he set aside every month for each child to achieve the goal? Harish maintains separate investment accounts for Chirag and Vishesh and invests till they individually turn 21 years of age.

Correct : A

Start a Discussions

Section C (4 Mark)

Read the senario and answer to the question.

If Mr. Mehta is paying interest rate 12%p.a on his housing loan and 10% p.a. on car loans, in how many months would he pay off his housing loan and car loan?

Correct : B

Start a Discussions

Total 1259 questions